## What Is Driving Inflation? - The Big Picture **Report Provider:** The Big Picture (by Barry Ritholtz) **Published:** July 30, 2025 **Topic:** Business / Economy This report challenges the prevailing narrative of "Inflationistas" who attribute all price increases solely to money printing. Instead, it argues that specific sector-level issues, largely unrelated to central bank actions, are the primary drivers of current inflation. ### Key Findings and Conclusions: * **Challenging the "Printers go Brrrrr" Narrative:** The article contends that while "Inflationistas" (including bond vigilantes, hard money advocates, Milton Friedmanites, Fed haters, goldbugs, and crypto bros) believe money printing is the sole cause of price increases, this view is simplistic and ignores underlying sectoral problems. The decade following the Global Financial Crisis (GFC) was characterized by *de-flation*, not inflation. * **Sector-Specific Inflation Drivers:** Most price increases are concentrated in services, while physical goods are generally experiencing below-average inflation. Specific sectors have unique drivers unrelated to central bank policies. * **Tariffs as a Persistent Tax:** Tariffs are described as a "persistent tax" on consumers, leading to sustained higher prices as long as they remain in effect, rather than a one-time price increase. ### Key Statistics and Metrics: * **Home Prices:** * The US is currently short **3 to 5 million** single-family homes. * This shortage is a result of an overbuild from 1999-2006 followed by over a decade of underbuilding, even as the US population grew. * It is estimated it will take years, possibly decades, to fully address this housing deficit. * **Automobiles / Auto Insurance:** * A **three-year production shortage** of new cars (2020-2022) directly impacted by pandemic shutdowns and semiconductor shortages. * This shortage led to a scarcity of used cars and parts, driving up prices for both new and used vehicles and increasing repair costs. * Resolution for this sector is estimated to take **three to five years**. * **Eggs:** * Over **169 million poultry** (primarily chickens) have been culled in the US due to avian flu since early 2022. * This represents a deficit of **40-50 million** chickens compared to the normal population of approximately 320 million. * Fewer hens directly translate to fewer eggs and higher prices. * **Tariffs:** * Tariffs are now rising to approximately **15%** across-the-board on most imported goods. * This acts like a consumption VAT tax on imported items. ### Specific Sectoral Inflation Drivers: * **Home Prices:** Driven by **supply limitations**, including a rising population, below-average construction, NIMBYism (Not In My Backyard), and a surge in second-home purchases during the pandemic. * **Automobiles / Auto Insurance:** Caused by **supply chain disruptions** stemming from pandemic shutdowns, a shortage of semiconductors, and the subsequent impact on new and used car availability and repair costs. * **Home Insurance:** Influenced by **severe weather events and natural disasters**, linked to climate change, which are increasing the frequency and severity of claims. * **Eggs:** Primarily driven by **avian flu**, leading to a significant reduction in the poultry population. * **Beef:** Affected by **drought and climate change**, which impact feed, labor, farmland, and rents, forcing ranchers to thin herds and driving up beef prices globally. * **Health Insurance:** Attributed to **rent-seeking behavior by lobbyists and insurance companies**, leading to higher costs and worse outcomes compared to other developed nations. The US healthcare system is described as an "oddity" where private sector performance is worse than mediocre government insurance. * **Drug Prices:** Driven by **pharmaceutical benefit managers (PBMs)**, a lack of competition, captured regulators, and lobbying efforts. The US is one of only two countries allowing direct-to-consumer advertising of prescription drugs, contributing to inflated prices that rise at double-digit rates. ### Notable Risks or Concerns: * **Labor Shortages in Construction:** The availability and management of migrant labor are identified as a wildcard affecting the pace of new home construction. * **Global Drought Impact:** Drought is a global problem affecting food supply, which can have cascading effects on other food prices. * **Healthcare System Inefficiencies:** The US healthcare system's high costs and poor outcomes, driven by industry influence, represent a significant concern. * **Tariff Impact on Consumers:** Tariffs are a persistent cost that will continue to affect consumer prices as long as they are in place, even if their impact on inflation metrics is registered as a one-time price increase. While some costs may be absorbed by exporters and retailers, this will affect their profit margins. ### Important Recommendations: The article implicitly suggests a shift in focus from broad monetary policy explanations to addressing specific, tangible issues within various economic sectors to effectively manage inflation. This includes: * Addressing housing supply shortages. * Resolving semiconductor supply chain issues. * Mitigating the impacts of climate change on insurance and agriculture. * Reforming the healthcare and pharmaceutical industries to reduce costs and improve outcomes. * Re-evaluating the impact and necessity of tariffs.

What Is Driving Inflation? - The Big Picture

Read original at The Big Picture →The Inflationistas are an eclectic mix of subgroups, beliefs, and ideologies. They count the bond vigilantes, hard money advocates, Milton Friedmanites, Fed haters, goldbugs and crypto bros amongst their numbers.Their unifying thread: Printers go Brrrrr.As a group, they believe that money printing is the reason for all price increases and, therefore, must be opposed.

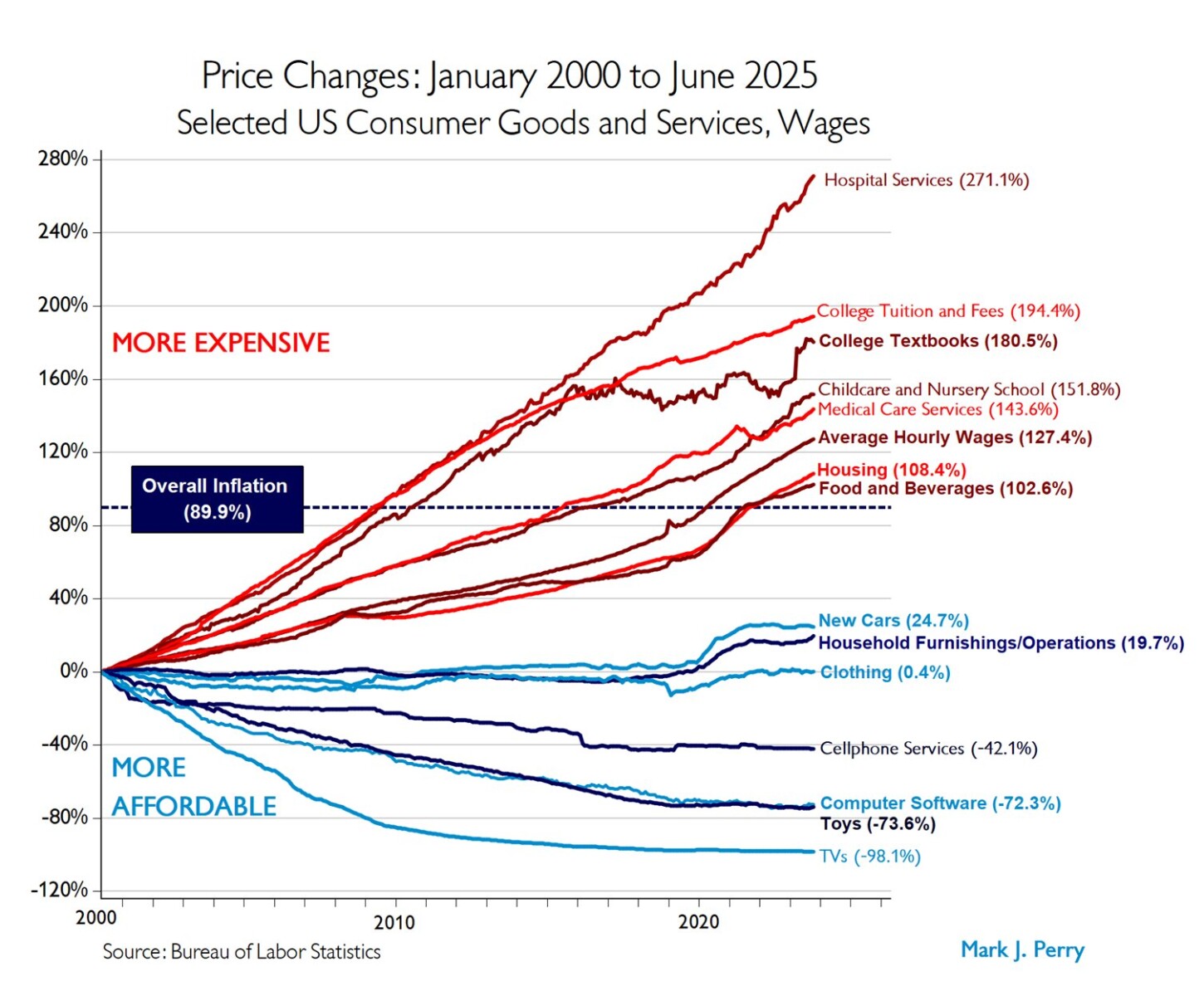

Never mind that the decade following the GFC was about DE-flation, not IN-flation…Have a look at the chart (via Mark Perry) above. It breaks down various sectors, showing what is above- and below-average inflation. It is noteworthy that most of the items in the above section are services; most of the items below average are physical goods.

Looking at this on a sector-by-sector basis, we can see that many of the biggest contributors to overall price increases have very specific drivers, none of which have anything whatsoever to do with the central bank.For those of you who are doubters, perhaps an inflation subsector analysis may be of interest:Home prices: Supply limitationsIt’s hard to deny that the combination of a rising population and limited, below-average construction of single-family homes has been a poor mix (see chart).

Add in NIMBY and the surge of second-home purchases during the pandemic, and it becomes clear that home prices are being driven mainly by supply issues.1.There was an overbuild of single family homes from 1999 to 2006. That was followed by more than a decade plus of underbuilding, even as the population in the U.

S. rose (We discussed this four years ago).Today, the U.S. is short 3 to 5 million single-family homes, and it will likely take years (decades?) to catch up fully.Automobiles / Auto insurance: Supply/Pandemic effectsLet’s combine these into one group, because it has the same basic drivers: Start with the shortage of new cars from 2020-22, directly affected by the pandemic shutdowns; add an insufficient supply of semiconductors (exasberating the problem).

A three-year production shortage of new cars means today we have a shortage of used cars – at least the vintages that would have been normally produced in 2020, ’21, and ’22. That also created a shortage of parts. This drove new and used car prices higher, and is making repairs for even minor accidents much more expensive than they might have been otherwise.

Best guess: Three to five years for this to resolve…Home Insurance: Severe Weather Events and Natural Disasters (Climate Change)Have you tried to price home insurance recently? Or (heaven forbid) flood insurance? Looked at areas near the ocean or a river, to say nothing of regions that suffer from tornadoes, hurricanes or wildfires?

I suggest anyone who denies climate change speak to an insurance underwriter to get a sense of how unprecedented the modern era of natural disasters is.The wild card here is labor, with many construction workers migrants. How that is managed affects how fast new homes can be built. (No clue as to when this gets resolved).

Chart: NOAAEggs: Avian Flu“Since early 2022, over 169 million poultry (primarily chickens) were culled in the US due to avian flu.” That’s over a three-year period. Normally, ~320 million chickens are being raised in the United States, and we are about 40-50 million below that level.Fewer hens = fewer eggs = higher prices.

Source: NerdWalletBeef: Drought/Climate ChangeInflation in one area can influence another. Beef illustrates this well. Feed, labor, farmland, and rents have all increased since the pandemic. That’s before Mother Nature throws droughts at ranchers, which forces them to thin their herds – sending beef prices higher.

Note that drought has become a global problem for the food supply.Health Insurance: Rentiers & LobbyistsWhy do we in the United States get our healthcare coverage through our work? It’s an oddity specific to the USA, and has led to some particularly poor outcomes.It’s no secret that healthcare in the United States costs twice as much as in the rest of the world, yet it produces worse outcomes.

We have allowed lobbyists and insurance companies to dominate healthcare. It is one of the rare parts of the economy where the private sector does a much worse job than even mediocre government insurance.Yes, there are many problems with other systems, but its hard to endorse double the costs for worse results.

Drug Prices: PBMHealth care is a weird industry, driven in part by our faith in doctors, a lack of competition, and captured regulators. Want to see how bloated drug prices are in the United States? See this analysis from the Drug Channels Institute (DCI). And they keep rising at double-digit rates.

Similar to overall health insurance, lobbyists and corrupt politicians have driven drug prices higher. Only two countries—the United States and New Zealand—allow pharmaceutical companies to run television commercials directly advertising prescription drugs to consumers. It is a sign of just how corrupt our health care system has become.

~~~It is into this environment tariffs arrive, now rising to ~15% across-the-board on most imported goods arrives. This acts like a consumption VAT tax on anything imported into the US.Allow me to clarify some confusion about the impact these tariffs will have on inflation.I keep hearing pundits repeat “Tariffs are a one-time tax;” I wince each time because it is both imprecise and incorrect.

Tariffs should be described as a “persistent tax” on consumers that leads to higher prices that last as long as tariffs are in effect.2.What I suspect the talking heads are referring to is the fact that the impact of tariffs only appears in CPI data as a one-time price increase. Inflation metrics, such as the CPI or PCE, measure the rate of change – not the absolute level of prices.

Goods that were priced at $100 may get tariffed to $115; the increase will only appear in CPI once, but the higher prices continue for as long as the tariffs remain in place.Source: Paul KedroskyPreviously:The Muted Impact of Tariffs on Inflation So Far (July 17, 2025)Revisiting Greedflation (November 16, 2023)Miscalculated Housing Demand (July 29, 2021)__________1.

June, usually the height of the spring housing season, saw sales of existing homes drop from the previous month, according to the National Association of Realtors. https://www.nytimes.com/2025/07/23/realestate/home-sales-drop-prices-rise.html2. We may also see some of the tariff costs getting absorbed by exporters and retailers, so it will show up in their profit margins for as long as they decide to eat some of the costs versus passing them along to the consumer.

But there is no free lunch — someone is absorbing these new costs.