## Humanoid Robots: A Global Race for Embodied Intelligence This report from **KrASIA**, authored by **KrASIA Connection**, details the burgeoning global race to develop and deploy humanoid robots, a field driven by the concept of "embodied intelligence." The article, published on **August 28, 2025**, highlights the rapid advancements and significant investments from both US and Chinese companies, positioning this as a trillion-dollar market with profound implications for the future of labor and technology. ### Key Findings and Trends: * **Embodied Intelligence is the Next Frontier:** The core concept is giving Artificial Intelligence (AI) a physical form to interact with the real world, moving beyond language models like ChatGPT to robots that can "use their hands and feet." * **Intense Global Competition:** A heated race is underway, primarily between US and Chinese companies, to build humanlike machines. * **US Companies: Pushing Technology and Products in Parallel:** * **Tesla (Optimus):** * **Vision:** Utilizes a vision-only system, eschewing LiDAR, drawing on its autonomous driving expertise. * **Motion:** Employs linear joints for increased power density, with leg actuators capable of holding half a ton and arms carrying 20 kg. * **AI Core:** Leverages Grok 4 as its cognitive core, trained on extensive data and supported by the Colossus supercomputer. * **Challenges:** Current work efficiency is only 20-30% of human workers, unit cost is around USD 60,000 (target USD 20,000-30,000), and core components like harmonic drives and dexterous hands have short service lives (less than a year and 1-3 months, respectively), hindering sustained operation and mass production. * **Figure AI:** * **Valuation Growth:** Rapidly increased valuation from USD 2.6 billion to USD 39.5 billion, backed by major players like Microsoft, OpenAI, Nvidia, and Jeff Bezos. * **Market Target:** Aims to capture the USD 40 trillion global labor market. * **AI Model:** Developing its own large models, including the Helix VLA (vision-language-action) model, described as a "ChatGPT for robots," capable of interpreting plain-language instructions and enabling robot-to-robot coordination through gaze cues. * **Challenges:** Faces significant data requirements for training VLA models, necessitating expensive and difficult-to-scale teleoperation data collection, and a lack of reliable long-term memory in current models, impacting multi-step task execution. * **China's Approach: Cost Control and Ecosystem Building:** * **Unitree Robotics:** * **Mass Market Focus:** Aims to make humanoid robots accessible to general consumers, releasing the G1 model at RMB 99,000 (USD 13,860). * **Cost Reduction Strategies:** Extreme cost control in design, leveraging scale effects from quadruped robot production, and utilizing China's manufacturing base. * **Strengths:** Strong track record in quadruped robots (over 60% global market share) and in-house development of core components like motors, structural parts, and sensors. * **Weakness:** Relies on classical control algorithms and third-party AI, lacking a frontier-scale AI model for its "brain." * **Agibot:** * **Ecosystem Approach:** Building a value chain through joint ventures with leading companies (Lens Technology, PIA Automation, Fulin Precision), aiming to accelerate progress and spread risk. * **Capital Activity:** Achieved RMB 15 billion (USD 2.1 billion) valuation and produced its 1,000th general-purpose embodied robot in January 2025, setting an industry record for speed to market. * **Challenges:** Shorter technology track record compared to US counterparts and high expectations tied to its capital activity, requiring successful commercial deployment to validate its strategy. ### Supply Chain Dynamics and Global Competition Layers: * **China's Manufacturing Dominance:** A Morgan Stanley report indicates that 56 out of 100 key companies in the humanoid robot value chain are Chinese, accounting for 63% of the supply chain, particularly in components like reducers, motors, sensors, and manufacturing services. * **Interdependence:** Even US companies like Tesla rely on Chinese suppliers for crucial parts. * **Three Deeper Issues in the Race:** 1. **Supply Chain Leadership:** China's cost advantage could narrow if AI algorithms and localized production lower design and manufacturing thresholds. A lack of frontier-scale AI models in China remains a concern. 2. **"Brain" vs. "Body":** The US leads in AI ("brain") development (Grok, OpenAI, VLA models), while China excels in hardware and manufacturing ("body") (reducers, motors, sensors). This interdependence reshapes global technology competition. 3. **Chinese Initiative:** Chinese enterprises need to move beyond engineering optimization and actively shape emerging technical standards and paradigms, where US players currently hold more influence. ### China's Gaps and Future Outlook: * **Foundational Algorithm Innovation:** Architectures like transformers and diffusion models largely originated in the US. * **Model Training Theory:** Advances in areas like backpropagation and reinforcement learning have primarily been led by US research. * **Compute Paradigms:** GPU-based parallelism and neuromorphic design have been shaped by US institutions and companies. * **Limited Window for Catch-Up:** The AI era presents a likely window of no more than ten years for China to catch up. * **Diminishing Value of Traditional Manufacturing:** As AI takes over design and production optimization, companies mastering core AI will have an advantage, potentially leaving those without it as mere contract producers. The report concludes by emphasizing the rapid pace of AI advancement and the shrinking timeline for commercial deployment of humanoid robots, posing the question of readiness for this transformative technological shift.

From sci-fi to factory floors: Humanoid robots at the crossroads of technology, capital, and ambition

Read original at KrASIA →Imagine this: Tesla’s Optimus robot, developed by Elon Musk’s team, calmly frying a steak in a kitchen. Figure AI, a newer Silicon Valley company, showing robots that coordinate through eye contact as they sort and move items. Unitree Robotics, in China’s factories, preparing for mass production of humanoid robots priced at RMB 99,000 (USD 13,860).

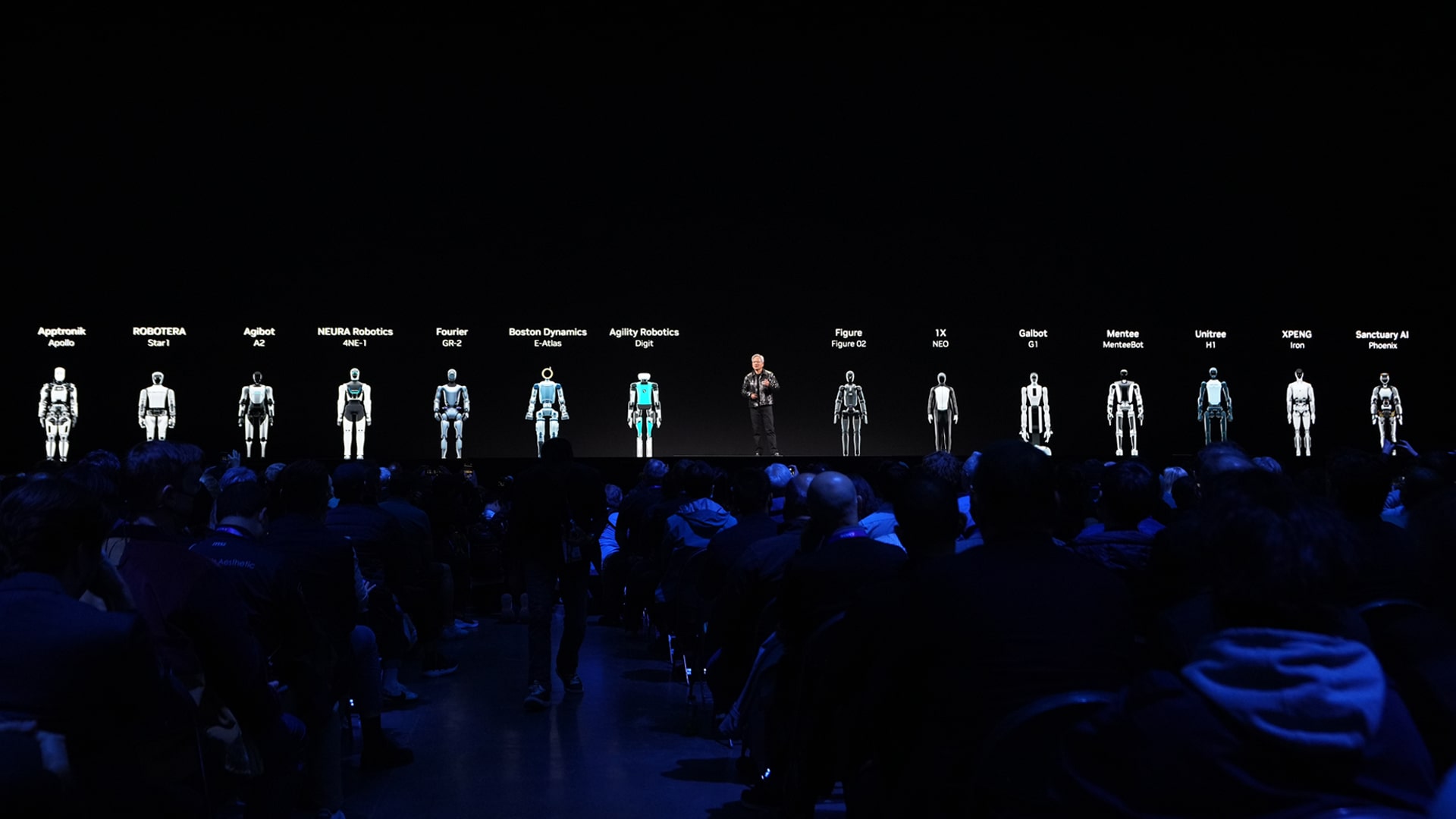

Scenes that once seemed like science fiction are now unfolding in real time.Two years ago, Nvidia CEO Jensen Huang predicted that embodied intelligence, essentially giving artificial intelligence a body, would be the next major trend. Many dismissed the idea. Today, a global race to build humanlike machines has entered a heated stage, with a future market measured in trillions of dollars at stake.

What is embodied intelligence?Embodied intelligence means giving AI a physical form so it can act in the real world. If ChatGPT taught AI to “speak,” embodied intelligence aims to let AI “use its hands and feet” to interact with the physical environment.Humanoid robots are considered the most complex path.

They combine a “brain,” advanced sensing, precision motion control, high-performance chips, and new structural materials.Each requirement is a high bar on its own, and industry leaders are pursuing all of them at once.US companies push technology and products in parallel“By 2040, there will probably be more humanoid robots than there are people.

”When Musk made this statement at the eighth Future Investment Initiative conference, many observers saw it as exaggeration. But after Tesla showed its third-generation Optimus performing ballet-like motions and cooking tasks, more people began to take it seriously.Tesla has tied its broader ecosystem to this project.

Since 2022, hundreds of suppliers upstream and downstream have been working toward the same goal: building robots that function like people.Three longstanding strengths underpin Tesla’s confidence:FSD-grade vision: Drawing on more than a decade of autonomous driving work, Optimus drops expensive LiDAR (light detection and ranging) tech and relies on a vision-only system to interpret the world.

Musk’s reasoning is straightforward. If cameras can support autonomous driving, they can likely support autonomous robot work.Linear joints and power density: Robots typically use rotary joints with limited force. Tesla applies planetary roller-screw linear joints to increase power density. An Optimus leg actuator can reportedly hold a half-ton piano, and its two arms can carry 20 kilograms.

This exceeds the load levels set for human workers under China’s occupational health protection framework, which requires employers to prevent hazards and comply with national safety norms.Grok as the control model: Grok 4 is positioned as Optimus’s cognitive core. It was trained on far more data than Grok 2 and reportedly surpassed the 50% threshold on a difficult general test.

Musk called it smarter than PhD students across fields. The model is supported by the Colossus supercomputer, which provides the computing power Optimus requires.Despite progress in perception and motion control, Optimus still falls short in practical use. Its work efficiency is only 20–30% of a human worker’s, and the unit cost is about USD 60,000, well above the stated target of USD 20,000–30,000.

More critically, several core parts have short service lives: harmonic drives may need replacement in less than a year, and dexterous hands may last only one to three months. These limits make high-intensity, long-duration deployment difficult.For now, Optimus is not yet a labor product that can be mass produced and scaled.

It performs, but sustained and stable operation remains a challenge.In the not-too-distant future, Tesla’s Optimus robots could be integrated into daily life, taking on roles in homes and workplaces. Image source: Tesla.Founded only a few years ago, Figure AI’s valuation has climbed from USD 2.6 billion to USD 39.

5 billion. Its backers include Microsoft, OpenAI, Nvidia, and Amazon’s Jeff Bezos. A recent USD 1.5 billion funding round further raised its paper value.Founder and CEO Brett Adcock is targeting what he calls the USD 40 trillion global labor market, which accounts for roughly half of global GDP.Like Tesla, Figure AI does not want to be only a robot hardware company.

Earlier this year, it ended its collaboration with OpenAI and announced plans to develop its own large models to control the core of embodied intelligence. At the announcement, CEO Brett Adcock said he expected to demonstrate capabilities “no one has ever seen on a humanoid [robot]” within 30 days.

Figure AI’s key technology is the Helix VLA (vision-language-action) model, a multimodal system that combines vision, language, and action. It has been described as a “ChatGPT for robots.”Unlike traditional robots, which require step-by-step programming, Helix can interpret plain-language instructions and determine how to execute them.

For example, if asked to “bring me that extinct animal,” it can reason symbolically, identify a dinosaur toy, and deliver it. Helix also enables two-robot collaboration, allowing robots to coordinate and adjust their actions during a task, including through gaze cues.Two major challenges remain:Data requirements: Training a VLA model demands large amounts of video, language, and action data captured in real physical settings.

Unlike language models trained on abundant internet text, Figure AI must collect much of its data through teleoperation, which is expensive and difficult to scale. This creates a bottleneck for growth.Lack of long-term memory: Current VLA models do not reliably retain long-term context. In multi-step tasks such as “prepare breakfast and clean the kitchen,” robots can lose track of earlier steps, reducing generality and exposing limits of the architecture.

Figure AI’s financing and technical ambition have made it a focal point in the industry, but overcoming these data and memory hurdles will take time and carry risk.Image of the Figure 02 humanoid robot, developed by Figure AI. Photo source: Figure AI.Cost control and ecosystem buildingCompared with US companies that spend heavily, China’s Unitree Robotics has taken a different path.

It aims to bring humanoid robots to the mass market. In 2024, it released the G1 humanoid at RMB 99,000, the first humanoid robot available to general consumers and, for now, the only one.While Tesla’s Optimus remains in the lab and Figure AI has not yet reached mass production, Unitree’s approach raises a basic question: why should robots be available only to wealthy buyers?

Keeping prices under RMB 100,000 (USD 14,000) is central to this approach. Unitree lowers cost in three ways:Extreme cost control: The design phase assumes mass production, with no unnecessary fasteners or parts.Scale effects: Volume production of quadruped robots allows parts sharing and reuse of the supply chain.

China’s manufacturing base: A complete industrial ecosystem lowers logistics and coordination costs.Unitree has a strong track record in quadruped robots. It claims more than 60% of the global market and develops all core components in-house, including motors, structural parts, and sensors. Its motor work allows precise motion by optimizing magnetic flux and streamlining motion profiles.

These capabilities are now applied to humanoids. At this year’s Lunar New Year gala, Unitree’s H1 performed alongside dancers, completing handkerchief tosses that showcased dynamic control.Unitree’s main weakness is software. It does not yet have its own frontier-scale AI model. Tesla uses Grok, Figure AI uses its VLA model, and Agibot has released Genie Operator-1.

Unitree still relies on classical control algorithms and third-party AI. Its robot body is close to industrial maturity, but its “brain” remains relatively limited.Image shows the G1, one of Unitree Robotics’ flagship humanoid robots. Image source: Unitree Robotics.If Unitree is the mass market player in China’s humanoid robotics field, Agibot is the higher-profile entrant.

Founder Peng Zhihui was one of Huawei’s youngest star engineers and reportedly received an offer above RMB 2 million (USD 280,000) a year at age 22. Chairman Deng Taihua spent more than two decades at Huawei as a senior vice president.The team brings a Huawei-style engineering approach and a strong ability to organize partners.

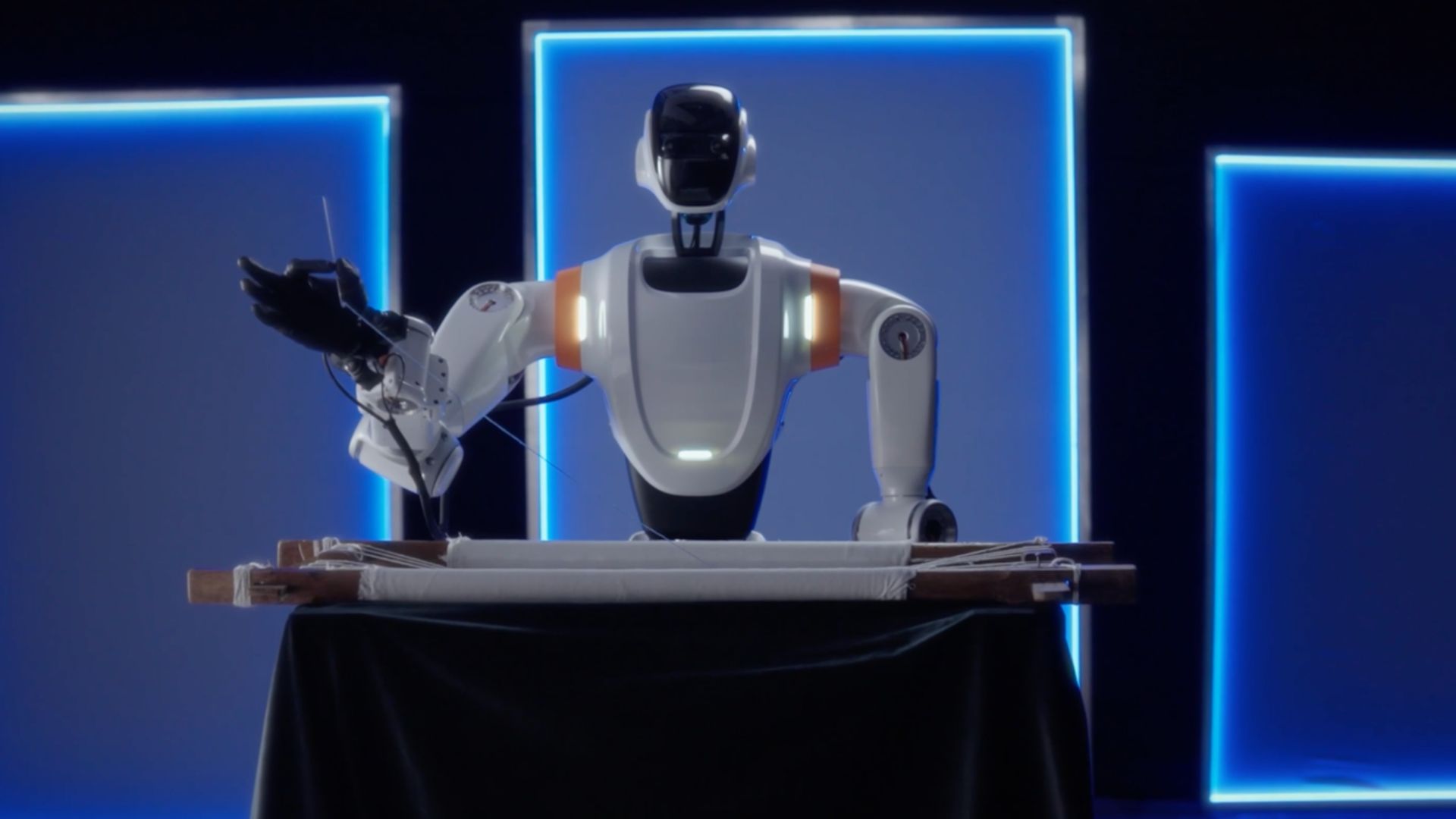

They chose to build an ecosystem. Agibot created a joint venture with Lens Technology, PIA Automation, Fulin Precision, and other leading companies to establish a value chain spanning materials, structures, manufacturing, and algorithms. The model spreads risk, shares returns, and accelerates progress.

A ground-up R&D path can take five to ten years, but the ecosystem approach can produce results in two to three.Agibot has also been active in capital markets. It moved to acquire control of Swancor Advanced Materials through agreement transfer combined with proactive invitations. Swancor’s stock recorded 11 consecutive limit-up sessions on China’s A-share market in July, seen as a representative acquisition after China issued new capital market rules that tightened supervision, strengthened delisting discipline, and encouraged longer-term investment.

Since its founding, Agibot has completed nine funding rounds and reached a valuation of RMB 15 billion (USD 2.1 billion). In January, its 1,000th general-purpose embodied robot rolled off the production line, setting an industry record for the time from founding to the first thousand units.Agibot still faces challenges.

Established only in 2023, it has a shorter technology track record. Compared with Tesla’s years of autonomous driving work and Unitree’s depth in quadrupeds, its moat is not as strong.Its capital activity also raises expectations. Meeting valuation and performance targets will test whether a strategy that combines technology and finance can deliver through commercial deployment.

Image of a humanoid robot from Agibot’s Expedition A2 series. Image source: Agibot.China’s manufacturing position and three layers of global competitionAlthough the leading names in embodied intelligence appear to form a US versus China lineup, their supply chains look similar. Many manufacturers behind core components are based in China.

According to a Morgan Stanley report, 56 of the 100 key companies in the humanoid robot value chain are Chinese, accounting for 63% of the supply chain. These include:Reducers: Leaderdrive, Zhongda Leader Intelligent Transmission (ZD).Motors: Inovance, Leadshine.Sensors: Orbbec, W-Ibeda.Manufacturing services: Lens Technology, PIA Automation, Ningbo Huaxiang (NBHX).

Tesla’s Optimus also relies on Chinese suppliers for crucial parts, such as Sanhua Intelligent Controls, Tuopu Group, Seenpin Electromechanical Transmission, and Beite Technology.However, this manufacturing advantage may not last. The humanoid robotics race highlights three deeper issues.First, supply chain leadership is not guaranteed.

China’s 63% share rests on cost and efficiency, but if AI algorithms and localized production reduce design and manufacturing thresholds, today’s cost advantage could narrow. Another concern is whether the industry has focused too heavily on assembly. Unitree’s attempt at full-stack development is a useful step, yet China still lacks frontier-scale AI models, which form the core of the “brain.

”Second, the central question for technological sovereignty is whether the “brain” or the “body” matters more. The US holds advantages at the “brain” layer, including Grok, OpenAI systems, and VLA-style models. China leads at the “body” layer, with strengths in reducers, motors, sensors, and structural parts.

A sophisticated robot design in the US depends on China’s supply chain to become a complete Optimus, while an affordable robot in China still requires robust AI to move beyond simple tasks. This interdependence is reshaping global technology competition, showing that neither technical leadership nor manufacturing strength alone is sufficient.

Third, Chinese enterprises must consider how to take greater initiative. Industrial revolutions tend to favor those who set standards and rules, and embodied intelligence is still at a stage where its technical paradigm has not been fixed. For now, the players with the most influence over emerging standards remain concentrated in the US.

China faces three gaps:Foundational algorithm innovation: Architectures, such as transformers and diffusion models, largely originated in the US.Model training theory: Advances, from backpropagation to reinforcement learning, have primarily been led by US research.Compute paradigms: GPU-based parallelism and neuromorphic design have been shaped by US institutions and companies.

To move ahead, Chinese companies will need to go beyond engineering optimization and take part in shaping system-level paradigms.Final thoughtsAI advances quickly. It took five years to move from GPT-1 to GPT-4, and commercial deployment of humanoid robots may take only three to five. In the AI era, China’s window to catch up is likely no more than ten years.

As AI takes over design and production optimization, the value of traditional manufacturing experience is diminishing. Companies that master core AI can shift manufacturing with ease, while those without it risk becoming little more than contract producers.The timeline is shorter than it seems. The question is, are we ready?

This article was adapted based on a feature originally written by Eastora (eastoragroup.com). KrASIA is authorized to translate, adapt, and publish its contents.