## Summary: Autoworkers Retraining for the Robot Revolution **News Title:** How autoworkers are retraining for the robot revolution **Source:** The Detroit News **Published:** September 3, 2025 (based on `publishedAt` timestamp) **Topic:** Technology, Automotive Industry, Factory Automation, Robotics This news report details the increasing integration of robots in the automotive industry, particularly focusing on how human workers are adapting to this shift through retraining and upskilling. While automation promises increased efficiency, safety, and product quality for automakers like General Motors (GM), Ford Motor Co., and Stellantis NV, it also presents challenges related to labor costs and potential job displacement. ### Key Findings and Conclusions: * **Automation's Dual Impact:** Robots are being deployed to handle repetitive, strenuous, and potentially dangerous tasks, improving worker ergonomics and safety. However, this also leads to a reduction in the need for traditional assembly line labor due to high labor costs in the United States. * **New Career Paths:** The primary solution for human workers is upskilling and retraining for roles that support automation, such as servicing, repairing, and managing robots. This offers job security and new career opportunities within the evolving automotive manufacturing landscape. * **Industry-Wide Trend:** All major automakers are investing heavily in automation, with significant examples from GM, Ford, and Hyundai. This trend is expected to accelerate. * **Final Assembly Automation:** While historically difficult to automate, even the final assembly process is seeing increased robotic integration, leading to fewer manual maneuvers for human workers. * **Tariff Uncertainty:** Trade tariffs, particularly those on steel and aluminum, are creating uncertainty that is temporarily slowing down major new robotics investments in the US, as companies await long-term policy clarity. However, in the long run, tariffs are expected to incentivize reshoring and thus further automation. ### Key Statistics and Metrics: * **Robot Installations:** Robot installations by automakers in the United States increased by **11%** last year. * **North American Robot Purchases:** In the first half of the current year, automakers and suppliers in North America purchased almost **9,000 robots**, accounting for approximately **half** of all robots purchased across all industries. * **Ford's Louisville Plant:** * A **$2 billion investment** is being made in the Louisville Assembly Plant. * The new plant will be Ford's most automated globally. * It will feature three streamlined sub-assembly lines with robots and AI. * The plant is expected to require about **40% fewer workstations** and **600 fewer workers** compared to current gas-powered SUV production. * Ford states these displaced employees will be offered work at another facility. * Automation levels in final assembly will be "substantially higher" than the typical "low single-digit percentages." * **Hyundai's Georgia Factory:** * Uses over **1,000 robots and automated guided vehicles**. * Will eventually work alongside more than **8,000 humans** when fully staffed. * Includes robotic dogs named Spot for quality control. * **Future Workforce Impact:** A QNX survey indicates global auto executives anticipate automation could replace **23% of their workforce on average over the next decade**. ### Significant Trends and Changes: * **Rise of Collaborative Robots (Cobots):** Smaller, safer cobots that can operate near humans without extensive guarding are becoming more prevalent. * **Humanoid Robots:** Automakers are beginning to experiment with humanoid robots for various tasks. * **AI Integration:** Artificial intelligence is being integrated into automated systems for tasks like defect detection using imaging tools, mirroring healthcare applications. * **Human-Robot Collaboration:** The future will see more shared spaces where robots and humans work in close contact, with robots becoming more flexible and capable of operating in unstructured environments. * **Upskilling as a Necessity:** Transitioning to trades and technical roles that service robots is increasingly seen as the only way for workers to ensure job security within the company. ### Notable Risks and Concerns: * **Job Displacement:** The primary concern is the potential for fewer jobs for human assembly line workers due to increased automation. * **Tariff Uncertainty:** Fluctuations and uncertainty surrounding US tariffs are causing automakers to delay significant new automation investments, opting for shifting existing production rather than acquiring new equipment. ### Material Financial Data: * **Ford's Investment:** **$2 billion** in its Louisville Assembly Plant. * **Cost of Labor:** Labor in the US can cost **five to seven times** the amount in other countries, making automation a cost-saving measure for automakers. * **Tariff Impact:** **50% levies** on steel and aluminum are mentioned as examples of tariffs affecting the industry. ### Recommendations/Implications: * **Worker Retraining:** The article highlights GM's apprenticeship program as a successful model for retraining workers into skilled trades that support automation. * **Focus on Maintenance and Servicing:** There is a clear demand for skilled workers to maintain and repair the growing number of robots. * **Adaptability is Key:** Workers need to embrace continuous learning and adapt to new technologies to remain relevant in the automotive industry. ### Historical Context: * The first robot, **Unimate**, was installed in a GM plant in **1961**. The narrative is exemplified by GM worker Annie Ignaczat, who transitioned from repetitive assembly work to servicing robots, finding a more engaging and secure career path. The report concludes that while the assembly line is the "last frontier" for automation, the trend is undeniable, and human workers who adapt will find new opportunities in this evolving industrial landscape.

How autoworkers are retraining for the robot revolution

Read original at The Detroit News →General Motors Co. worker Annie Ignaczat spent years walking in circles on concrete factory floors, assembling the same parts and counting down hundreds of pieces she and her coworkers needed to finish before lunch.“You’re doing the same movement hundreds, if not thousands, of times every day for the week,” Ignaczat said.

“It wears your body down.”Work at GM’s Parma metal plant near Cleveland was monotonous, she said, and the risks of knee and shoulder replacements caused by the stress of repeated movements were well known.Over time, Ignaczat watched the facility become more automated, adding new robots to complete the same tasks that she once performed.

She didn’t immediately see another option for herself until co-workers urged her to join a GM apprenticeship program at the carmaker’s Technical Learning Center in Warren."I used to do a job that a robot does now,” she said. “But now, my new job being in the trades, I service the robot. So when the robot breaks, that’s what I work on.

”Automakers, including GM, Ford Motor Co. and Stellantis NV, often point out how robots are used to increase safety, ergonomics and product quality. But experts say another benefit of robots for automakers is keeping labor costs down, meaning fewer jobs for humans.“You’re going to see lots more automation because assembly labor is expensive,” said Dan Hearsch, global co-leader of automotive and industrial practice at the consulting firm AlixPartners.

That’s especially true for companies setting up new manufacturing sites in the United States, he said, where labor can cost five to seven times the amount in other countries.Still, Ignaczat’s story is one template for human success in a time of rising automation. With upskilling through GM’s apprenticeship program, she will take on the role of fixing and managing the increasing number of robots picking, hauling and assembling parts.

“A lot more people are seeing that’s the only way really to have the job security and know they can stay with the company,” she said.Ford's new automated plantThe auto industry first adopted robots in the factory back in 1961 with a machine called Unimate that was installed in a New Jersey GM plant.

Now, all types of robots can be found in auto plants, shaping sheet metal and parts, welding together bodies and painting. And there are signs that higher levels of automation are coming — even in the car's final assembly process, which has been notoriously tough to automate due to its complexity and moving lines.

Take Ford, which last month announced a $2 billion investment in its Louisville Assembly Plant to build a new $30,000 electric pickup truck. The factory — which Ford says will be its most automated in the world — will include three streamlined sub-assembly lines that incorporate robots and artificial intelligence features.

The new system will limit the number of difficult maneuvers that employees must perform to install parts.The plant is expected to require about 40% fewer workstations and 600 fewer workers to keep running than are currently needed to build gas-powered SUVs, though the carmaker said those extra employees will be able to find work at another facility.

“What this does is, in the final (assembly) where typically you're in the low single-digit percentages in automation, we're substantially higher than that,” said Bryce Currie, Ford’s vice president of manufacturing for the Americas, of the revamped plant.Another example is Hyundai Motor Co. The Korean automaker recently opened a Georgia factory to build EVs; it says the facility uses more than 1,000 robots and automated guided vehicles that will, when fully staffed, eventually work alongside more than 8,000 humans.

Among them: robotic dogs named Spot that conduct quality control tasks.The company said last week it will set up a new robotics innovation facility in the United States to develop and produce additional robots for its factories.GM says beyond adding robots to handle repetitive or heavy tasks, it is integrating automation features in the product development phase, and as it checks for defects.

Ed Duby, who heads propulsion systems for the Detroit automaker, said the company now uses imaging tools often found in health care to analyze issues in batteries or engine parts, rather than workers needing to carefully take them apart. Those images can then be paired with machine learning to more quickly identify defects on other components.

The near future of auto manufacturing — including Ford’s revamped Louisville plant — will include more shared spaces where robots and humans work in close contact, said Winston Leung, senior strategic alliances manager at QNX, a software company involved in the automotive and robotics industries.They will be “more flexible and collaborative,” he said, and thanks to sophisticated sensor systems, they will be capable of “operating in a much more unstructured environment.

”"In this environment, I think where we've seen robotics and what we defined as automation in the past is going to be really different than what we'll see in the future," Leung said.Tariff effectRobot installations by automakers in the United States were up 11% last year, according to the International Federation of Robotics.

In North America, automakers and suppliers bought almost 9,000 robots in the first half of this year — an increase from last year and accounting for about half of the robots purchased across all industries, according to data from the Ann Arbor-based Association for Advancing Automation.Still, analysts and executives said the robot market’s growth is being temporarily held back by uncertainty around President Donald Trump’s tariffs as well as a pullback in EV investments.

In theory, higher tariffs mean auto companies will need to shift more of their manufacturing to the United States, and that will mean building more automated factories to save money on the higher cost of labor.But Hearsch said companies are still holding off on these big decisions, as they continue to wait and see how Trump’s tariffs play out and which levies will remain in place long-term.

Any companies looking to make a quick move stateside to avoid tariffs aren’t likely to be buying up lots of new robotics and other equipment, he said, but rather shifting their existing production line from another country to a building in the United States.In the longer run, though, robot companies that serve the auto industry expect to capitalize on Trump’s reshoring push — even as some of their own imports are hit by higher tariffs that include 50% levies on steel and aluminum.

“The high cost of labor is on everybody’s mind,” said Ed Marchese, head of automotive at ABB Robotics, which has its U.S. factory in Auburn Hills. “So as companies look to reshore, the question is, how am I going to be competitive? At the end of the day, take the tariffs away, take all the other political stuff away, anybody producing in this country still has to be globally competitive.

”He expects automakers and suppliers to have more clarity by the end of the year, and that will mean a rise in robot sales. “Robots are coming — we have faith in the market,” Marchese said during a tour of the company's Michigan factory earlier this summer.Jeff Burnstein, the president of the Association for Advancing Automation, said the auto plant assembly line remains “the last frontier” for automation in the industry.

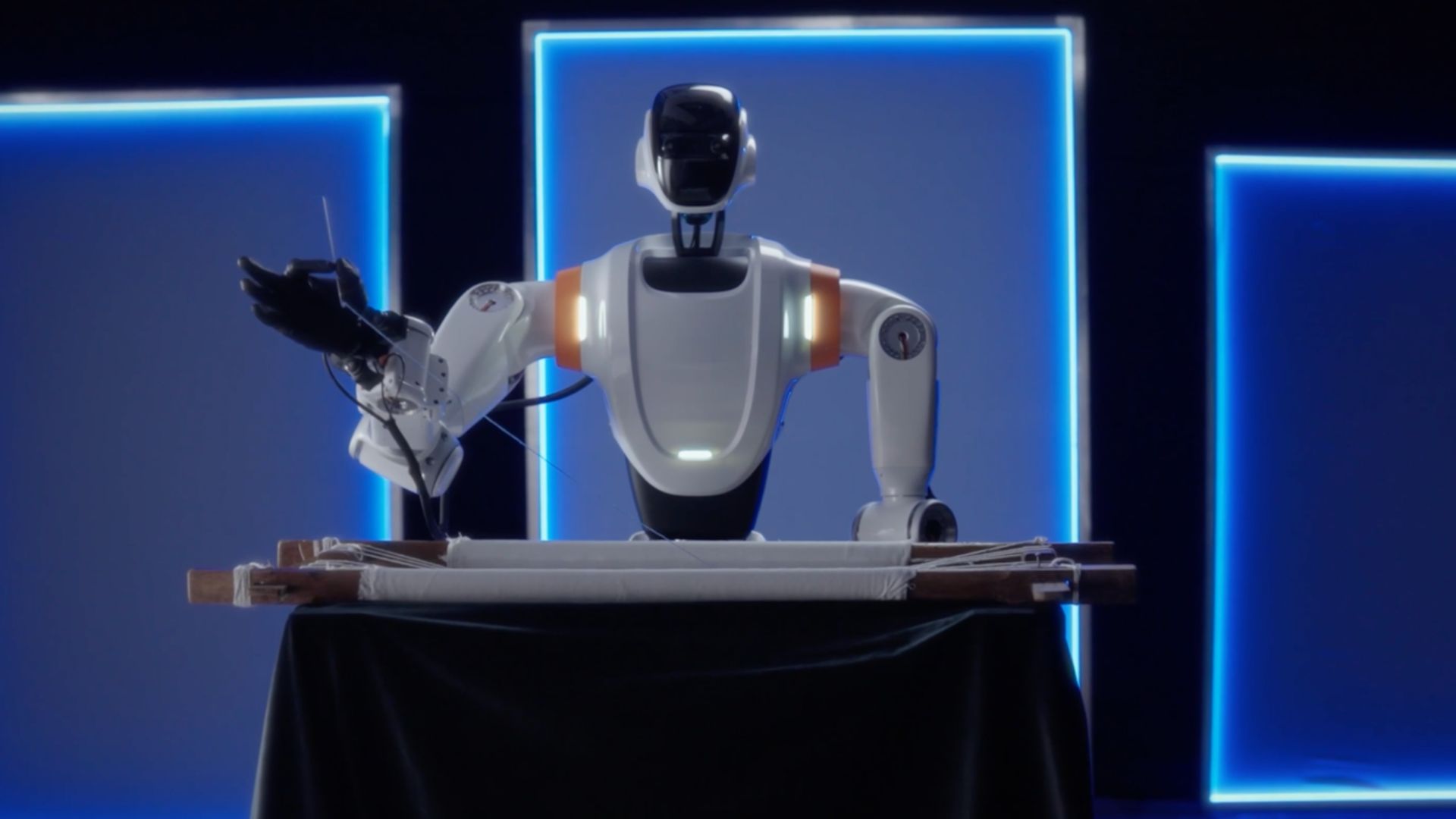

But there are robotic solutions that are set to take over certain tasks even in that complex part of the production process.They include smaller and safer collaborative robot arms, or cobots, which don't require fencing or other guarding to operate near humans. There are also humanoids, or robots that resemble a human body and often can carry out several types of tasks.

Burnstein said a few automakers are starting to experiment with how to use humanoids in the factory.One recent survey from the firm QNX found that global auto executives anticipate automation can replace 23% of their workforce on average over the next decade. Respondents also showed more comfort and trust in using robots than in any other industry.

But a fully automated car plant? Burnstein said it’s hard to foresee.“There’s too many tasks that people are required for,” he said. “And I think also, people have to oversee these machines. People have to determine what to do with the data that they’re getting. (Automakers have) definitely increased the amount of automation, especially in some of their newer (plants).

But when I talk to them, they still talk about all these jobs still there for people to do.”Ignaczat, the GM worker, said she's looking forward to her new career path after transitioning from the production line routines that used to fill her days. Now, "every day, I come in, and I'm working on something different," she said."

It’s an exciting time to actually see more of our floor people transition to the trades, so that way they can have that job security,” she said. "There's a ton more robots coming in, but they all need servicing, and there's always something that's wearing out and does need the maintenance. So it's a great time to get into the trade."

sballentine@detroitnews.comlramseth@detroitnews.comStaff Writer Breana Noble contributed. Facebook Twitter Email